BelFish,

I just happened to have some time tonight and I stumble upon your thread, and since I see you have put a lot of time into this thread, my main reason for posting is to let you know that I find it interesting. Thank You!

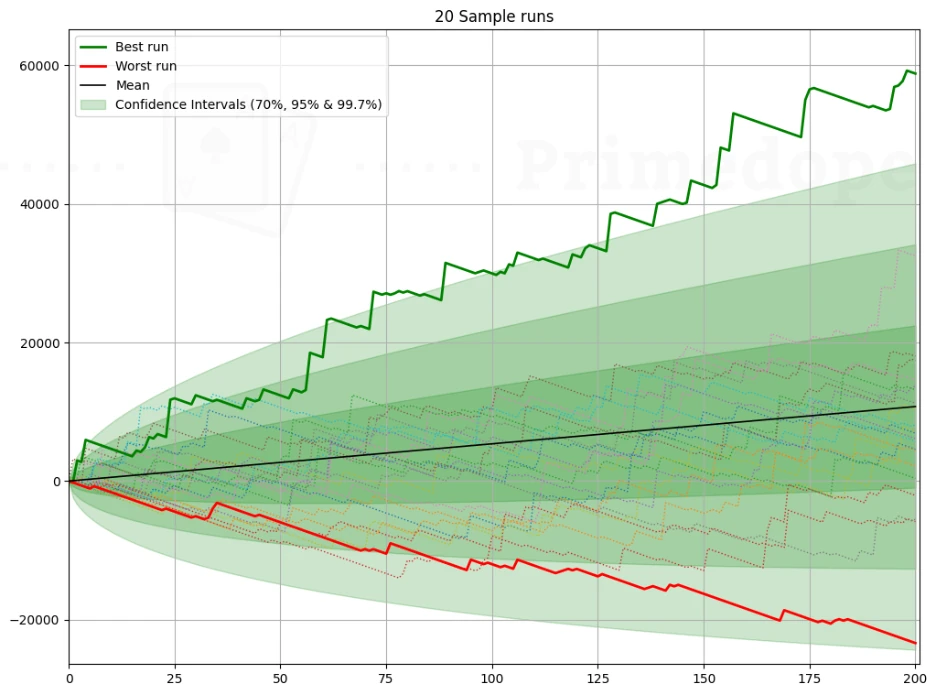

Disclaimers are 1) I do not play much heads-up sng's 2) I am just a recreational player and do not play to strict "Bank Roll Management" but then again, I try not to play stupid/careless with my Poker/ Wagering $'s either, 3) I am only very generally familiar with the Kelly Criterion, but I get it... I almost consider it to be like a mathematical version of common sense / realistic / responsible play/wagering, but then again, I am not trying to make a living at it. For me, it is more like just trying to be semi-responsible with my entertainment dollars, and 4) I did have some difficulty understanding the details of some of the charts and graphs, but I think I got the general idea.

Having said that, I will say that I enjoy math, recreational poker and sports betting. So I will make a few comments, and you can correct me where I am off base, mainly for purposes of my understanding and to just engage in this conversation. So I think I see where you are going with this... it seems you are thinking that you can play more aggressive than the Kelly Criterion would dictate, and be more profitable... but you give yourself the opportunity of being able to re-load or possibly add to the bankroll. I think this is where the difference comes in... The Kelly Criterion, I believe, is based on avoidance of ruin of a fixed bankroll. So it is not surprising to me, that if you allow yourself some opportunity to re-load, if necessary, or possibly do some add-ons to bankroll, if necessary, that you could post more favorable results.

So if I am following up to this point, I get that if you are playing responsibly within your means, and having good results at various levels of progression in stakes. In this case, I think this is a very reasonable and interesting topic to explore. I think the next question becomes, at what point do you "take your profits" and reset, or move back in level of play? Otherwise, without this reset/profit taking, I would think you do ultimately face the risk of ruin as a result of being more aggressive than the Kelly Criterion dictates. This is probably where I would need some more elaboration on the direction of the experiment, or just a better understanding of the Kelly Criterion, lol. And of course, that is assuming that I am following where you are going with this. I very likely could be off-course in my interpretation, and feel free to correct me.

Thank You Again For The Work You Have Put Into This Topic, Belfish!