F Paulsson

euro love

Silver Level

Well, uh... I could have measured the frequency, too, of course, but instead of having to measure or calculate the profit from x*y, I just let the program return the profit from each bet size. I mean, you have the same data in the graph, effectively, since Y doesn't actually show average profit but total profit (a minor lie that doesn't affect the point since all bet-sizes had the same number of tries; dividing each value by 1000 just changes the scale not the shape) so it's just a matter of what I choose to graph. As profit was what I was interested in, I went with profit.I'm not sure thats correct FP.

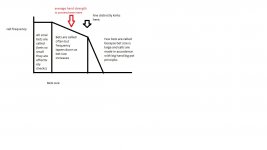

You have a graph of y= profit and x = bet size.

Surely you should have instead a graph of y= frequency of call x = bet size and the area of the rectangle under the intersection point the graph represents profit.

The thing is that for your profit to be higher betting less than the amout his average hand would call, the shape of this graph would have to have a distinct kink in it at the point of the average call.

I think the elastisity of calls does change above a certain threshold because when you bet large you create a potsize that so few hands can comfortably call but for you to justify betting less tan the average call amount, the shape of the graph preceding this point would have to be extremely steep.

Nicely put FP.

Did you also take the possibility of opponent being more likely to come over the top and bluff/shove into account?

I'm not sure what you mean by distinct kink.

I still don't get why you think call frequency is a better Y-axis than profit, since it's profit we're actually interested in. I mean, I could plot the calling frequency if you want me to, but in order to find out profitability you'd then have to multiply each Y-value by the corresponding bet-size which is what I did to begin with. I saved us that step, effectively.Therefore the slop of the middle section of the line would have to be very steep (which it might be, but we haven't really established that).

I still don't get why you think call frequency is a better Y-axis than profit, since it's profit we're actually interested in. I mean, I could plot the calling frequency if you want me to, but in order to find out profitability you'd then have to multiply each Y-value by the corresponding bet-size which is what I did to begin with. I saved us that step, effectively.

And honestly, I still have no idea why you think there will be a kink, even with a calling frequency plot. As I said in the original post (and implied in the description of the algorithm), the drop-off in calls is linear. No kink. Just a straight line to 0.

I made a model that I think is reasonably close to actual situations in order to be able to draw conclusions from it. If you think the model will yield the wrong conclusion for the situations it's a model of, feel free to point out where.Ok keep it easier, just have a downward sloping line.

Is the line elastic or in-elastic?

This is what you havent really established.

You are assuming an inelastic line, but havent really said why that is.

Raises are not included anywhere. Y is basically call frequency * bet size.I think I'm a little lost too. Is y profit, thereby including shoves over the bets, or just call frequency?

This doesn't actually matter. I mean, it matters if you're looking for an answer to "how much should I bet with AK when my opponent has JT" but that's not what I'm trying to solve. All the model shows is that IF your opponent has a maximum amount that he will call and IF there is some uncertainty but not much about exactly where that point for him lies, then you should bet on the low end of that range of sizes.And, is x bet size in dollars, or bet size relative to pot size? I guess unfortunately pot to stack ratio plays a part too, ie. if villian now has more than pot or less that pot remaining, but then maybe you always take that into consideration with the turn bet size.

Thanks - the lesson to take home is basically that if your thinking is "I think he'll call somewhere around $25-$40", you should bet a lot closer to $25 than $40. Probably something like $28.But if x is bet size relative to pot size, I'd love to know what x is on that scale. If the sweet spot is 40% to 75%, it would be nice to target that. Mind you, that sweet spot is going to vary by limits, and I don't know that I have enough data to try to plot that myself for my game.

But as always, great post.

I made a model that I think is reasonably close to actual situations in order to be able to draw conclusions from it. If you think the model will yield the wrong conclusion for the situations it's a model of, feel free to point out where.

Please clarify your question then, because I thought I had. If I left it unanswered, it's because I don't understand what your actual question is and how it relates to what I'm trying to say.I have already done that, but the question I pose is not being addressed.

Please clarify your question then, because I thought I had. If I left it unanswered, it's because I don't understand what your actual question is and how it relates to what I'm trying to say.

I have already answered this, but perhaps I wasn't clear enough. I'll try again.What I'm asking is simply why is the reduced bet size getting a disproportionally greater number of calls?

This must mean that the slop of the line of call frequency is very steep (its easier to see this if you plot call frequency rather than profit).

What is unclear is why this line is steep.

I have already answered this, but perhaps I wasn't clear enough. I'll try again.

Instead of thinking about one opponent as having an uncertain maximum calling amount within a certain range, think of having a large population of different opponents, who together span this range. What I've assumed in the model is that they're going to be somewhat uniformly distributed in this range.

What this means it that for the range of bet sizes we choose, the calling frequency will go from 100% to 0%, linearly.

When you speak of "elastic" and "inelastic" I'm assuming you're referring to economic theory of supply and demand, which is not a bad analogy for what we're doing here. But the problem, I think, is that you're "crossing the river to fetch the water" (to borrow a Swedish expression to which I don't know what the English equivalent is) when you want to look at call frequency ("demand") and bet size ("price") to try to deduce where the best profit lies, because the profit was plotted in the original graph. Since the original profit graph is implicitly built from the call frequency values, it's impossible for the other plot to give you a different conclusion.

The model is responsive, to use your term, because it's a direct effect of having a uniformly distributed range to begin with. It cannot be another way. Or is the "why" in regards to why I think that's a reasonable assumption to make? As I said in the original post:Sorry Paul, I'm not trying to be difficult but this dosent answer the question.

Everything you just wrote I agree / understand / think is correct.

Elasticity is indeed an economic term, simply put its the responsiveness of the line to change. So in the case of betsize to call frequency the steep line will be very responsive to change, a small decrease in betsize will yield a large number of extra calls.

A shallower (more horizontal taper) would be less responsive thus a decrease in bet size would again have an increase in call frequency but a small increase (one that most likely would lead to a reduction of profits).

I am open minded to either scenario, I really couldn't tell you if its responsive or unresponsive; I don't know.

You are telling me its responsive. OK why?

I should probably have said "general" conclusion: That we should bet smaller than the average calling amount. The shape of the graph will be different with a normal distribution, but our profit will still peak somewhere before the average point.I used a uniform distribution for their calling amount. In other words, their breaking point was as likely to be $85 as $115, when the reality probably is different; perhaps a normal distribution around the average? This would affect the shape of the graph, but not the conclusion.

But that's trivial to calculate. Both in general and from the specific values I used. But you can even generate those values yourself:I really think you plotting y = profit rather than y= call frequency has led to this confusion because its masking how many extra calls are required to show a greater profit when using a smaller bet size.